SAN DIEGO – May 6, 2020 – Cubic Corporation (NYSE: CUB) today announced its financial results for the second fiscal quarter ended March 31, 2020.

Second Quarter Fiscal Year 2020 Highlights

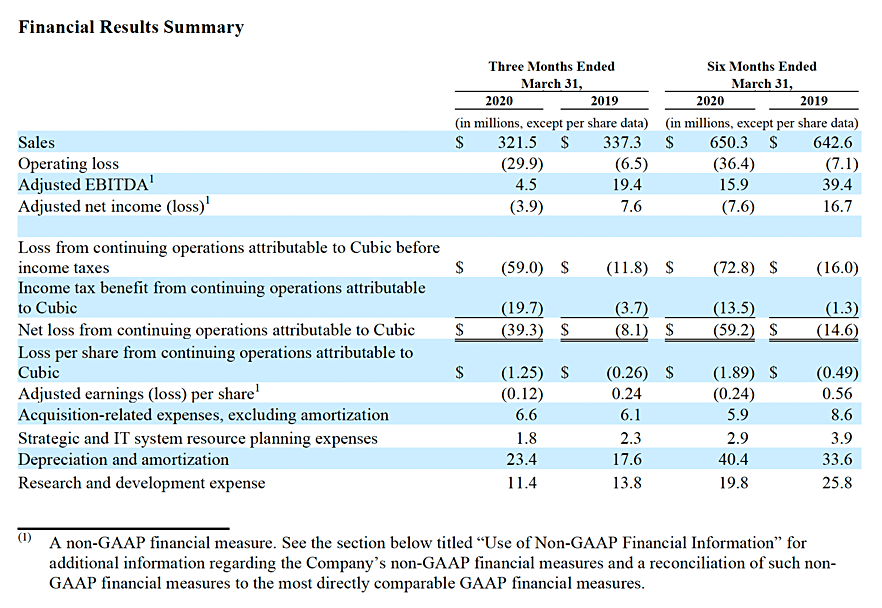

- Sales of $321.5 million, down 5% year-over-year

- Net loss from continuing operations attributable to Cubic of $39.3 million, or $1.25 per share, compared to $8.1 million, or $0.26 per share in the second quarter of fiscal 2019

- Adjusted EPS of ($0.12), compared to $0.24 in the second quarter of fiscal 2019

- Adjusted EBITDA of $4.5 million, compared to $19.4 million in the second quarter of fiscal 2019

- Closed Pixia and Delerrok acquisitions, advancing NextMissionTM and NextCityTM strategies

- Strengthened financial flexibility with restructuring of debt and increased availability under the Company’s revolving credit facility

- Implemented a cost savings program with expectation to drive cumulative net savings of $30 million to $35 million through fiscal 2021

- Repurposing capabilities to support COVID-19 relief efforts

- Suspending previously announced fiscal 2020 guidance due to uncertainty surrounding the COVID-19 pandemic

“Our number one priority at Cubic is the health and safety of our team members, customers, partners and communities. I want to thank our employees for their commitment to serve our customers during these unprecedented times. We are supporting our customers and communities impacted by COVID-19 by repurposing our capabilities to produce protective gear, ventilators and game-based training solutions,” said Bradley H. Feldmann, chairman, president and chief executive officer of Cubic Corporation. “While we are experiencing short-term impacts and challenges, we have taken the necessary actions to navigate this environment and the long-term fundamentals of our businesses remain strong. Cubic is well-positioned to drive growth by solving our customers’ hardest challenges.”

COVID-19 Response and Business Update

Employee Safety and Well-being

The Company is focused on keeping its employees safe through increased sanitation measures as well as social distancing and additional safety protocols. The Company has taken the following key actions in response to COVID-19:

- Established a COVID-19 working group that meets daily

- Maximized remote work

- Increased frequency of cleaning and sanitation

- Following social distancing and additional safety protocols for “site-essential” employees

- Monitoring health and well-being of employees

- Restricting non-essential travel

Cost Reduction and Cash Preservation

In response to the uncertainties arising from the COVID-19 pandemic, the Company has undertaken a cost reduction and cash preservation program, which is expected to result in cumulative net savings of $30 million to $35 million through fiscal 2021. The Company has taken the following actions to reduce costs:

- Reduced discretionary expenses

- Optimized overhead costs

- Reduced and deferred select research and development (R&D) investments while continuing critical investments to support near-term growth; expect fiscal 2020 investment in innovation to increase compared to fiscal 2019

- Reduced Board and CEO cash compensation by 15% and CFO by 7.5% for remainder of fiscal 2020

- Suspended employee salary merit increases through fiscal 2021 and 401(k) match for remainder of fiscal 2020

- Implemented hiring freeze for indirect and overhead positions

- Utilized stimulus benefits, including the monetization of certain net operating losses and the deferral of certain tax payments

Balance Sheet and Liquidity

Cubic expects to have sufficient liquidity to continue business operations during the evolving economic conditions surrounding the COVID-19 pandemic. The Company strengthened its financial position during the quarter by entering into an amended and restated credit agreement, providing Cubic with a new $450 million unsecured term loan and upsizing Cubic’s existing unsecured revolving credit facility from $800 million to $850 million. This transaction increases Cubic’s capacity by 30% to a total of $1.3 billion and improves its financial flexibility due to more flexible covenants, interest savings and an improved maturity profile. The Company remains focused on lowering its net leverage to its target of below 3.0x in the future.

Relief Efforts

Cubic is repurposing capabilities to support its employees, customers and communities. The Company has manufactured general purpose face coverings and made them available to all Cubic employees and their families. Additionally, Cubic is delivering face coverings and other protective gear to customers, including the New York Metropolitan Transportation Authority and the U.S. Navy. Cubic continues to assess additional opportunities to support relief efforts, including repurposing the Company’s inflatable satellite antenna technology to build ventilators and leveraging its expertise in game-based training to develop immersive, synthetic solutions to train medical professionals.

Business Update

Cubic’s businesses have been deemed essential services under applicable law and remain operational during the COVID-19 pandemic. Cubic has implemented preparedness plans to ensure business continuity, while focusing on protecting the health and well-being of its employees and the communities in which the Company does business. Overall, while the Company is experiencing customer-driven delays and other impacts, the Company believes that the long-term strategy and secular trends for all of Cubic’s businesses remain intact.

Cubic Transportation Systems (CTS)

The substantial majority of revenue from CTS is earned under fixed-price contracts. However, approximately $25 million of the Company’s annual revenue, or less than 2% of Cubic’s fiscal 2019 full year sales, is earned based on transit ridership. While Cubic’s financial exposure to ridership is limited, its transportation agency customers are experiencing reduced revenue which could delay future orders. Additionally, while Cubic has not experienced significant disruptions to its planned delivery schedules on major projects as a result of COVID-19, the Company may experience impacts in the future, including short-term delays.

Cubic Mission Solutions (CMS)

CMS has experienced some order delays as a result of COVID-19; however, the business continues to actively write proposals as the U.S. National Defense Strategy continues to drive demand in the Company’s markets. As COVID-19 continues, Cubic may experience delays of orders and customer acceptance processes could be disrupted by government-imposed travel restrictions. To mitigate these potential impacts, Cubic is partnering with customers on revised acceptance procedures.

Cubic Global Defense Systems (CGD)

CGD has experienced slowdowns in on-site defense training work and certain customer orders have been delayed as a result of COVID-19, but generally customer budgets are in place and orders are anticipated later in fiscal 2020.

Additional Information

For additional information on Cubic’s response to COVID-19 as well as observations on notable trends and developments, please refer to the supplemental earnings presentation on the “Investor Relations” section of Cubic’s website at https://www.cubic.com/investor-relations.

Consolidated Second Quarter Fiscal Year 2020 Results

Sales for the second quarter of fiscal 2020 decreased 5% as reported and 4% on an organic basis to $321.5 million, compared to $337.3 million in the second quarter of fiscal 2019, reflecting growth in Global Defense Systems, offset by a decline in Mission Solutions while Transportation Systems organic sales were flat.

Operating loss in the second quarter of fiscal 2020 was $29.9 million, compared to $6.5 million in the second quarter of fiscal 2019. The increase in operating loss was largely driven by Mission Solutions due to lower sales of high margin products, as further described in the segment results below. Additionally, unallocated corporate expenses increased to $16.8 million, compared to $12.0 million in the second quarter of fiscal 2019, partially driven by higher restructuring charges and an increase in stock-based compensation expense.

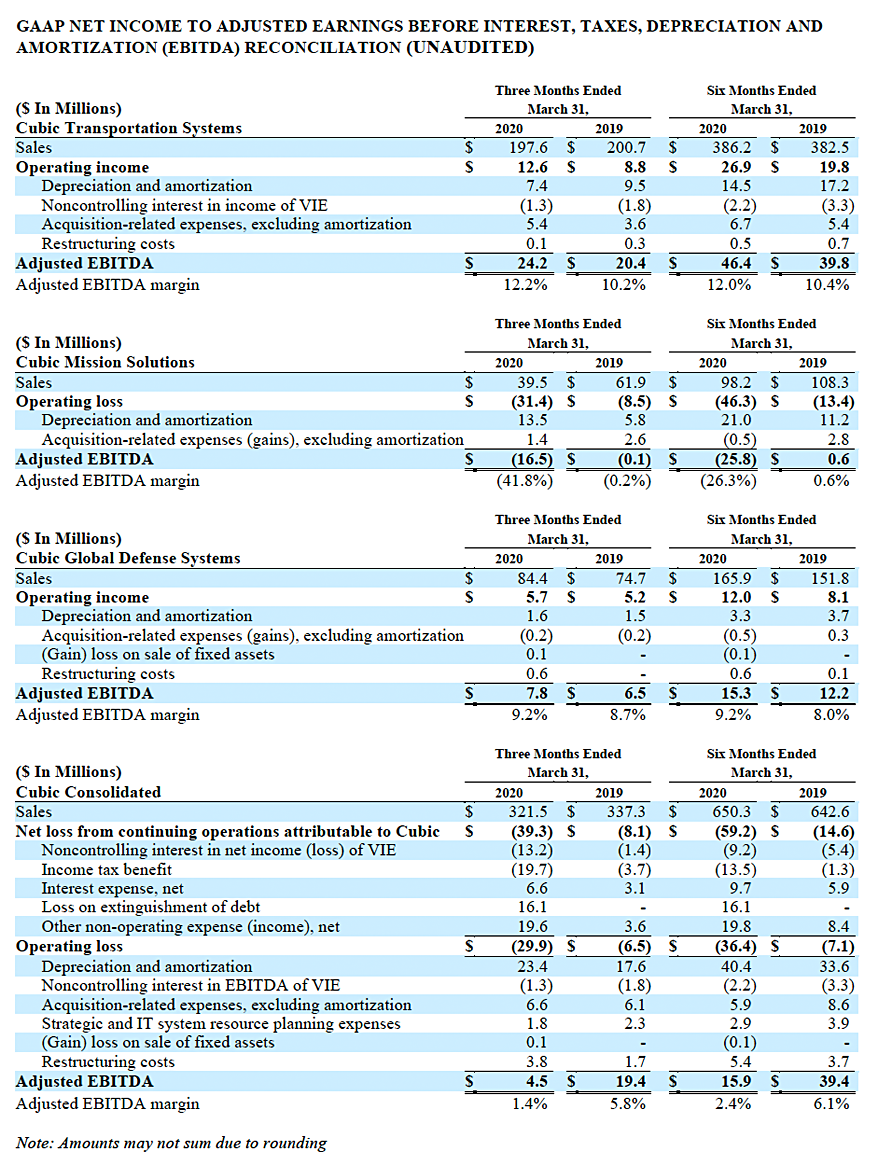

Adjusted EBITDA in the second quarter of fiscal 2020 decreased to $4.5 million, compared to $19.4 million in the second quarter of fiscal 2019, primarily due to the same factors that drove a higher operating loss, except for the increase in restructuring charges as that is excluded from Adjusted EBITDA.

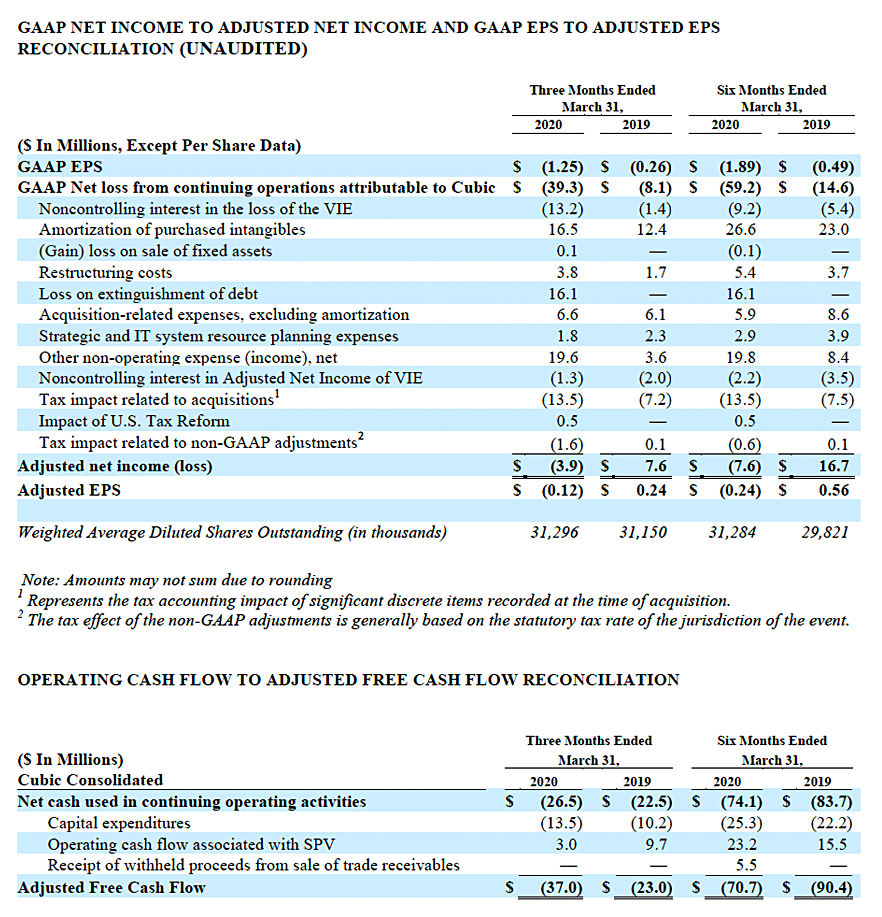

Net loss from continuing operations attributable to Cubic in the second quarter of fiscal 2020 was $39.3 million, or $1.25 per share, compared to $8.1 million in the second quarter of fiscal 2019, or $0.26 per share, primarily reflecting an increase in operating loss and interest expense as well as a $16.1 million loss on extinguishment of debt.

Adjusted net loss was $3.9 million, or $0.12 per share, in the second quarter of fiscal 2020, compared to Adjusted net income of $7.6 million, or $0.24 per share, in the second quarter of fiscal 2019, reflecting lower Adjusted EBITDA and higher interest and depreciation expense, partially offset by tax benefits.

Net cash used in continuing operations was $26.6 million in the second quarter of fiscal 2020, compared to $22.5 million in the second quarter of fiscal 2019. Adjusted Free Cash Flow was negative $37.0 million in the second quarter of fiscal 2020, compared to negative $23.0 million in the second quarter of fiscal 2019.

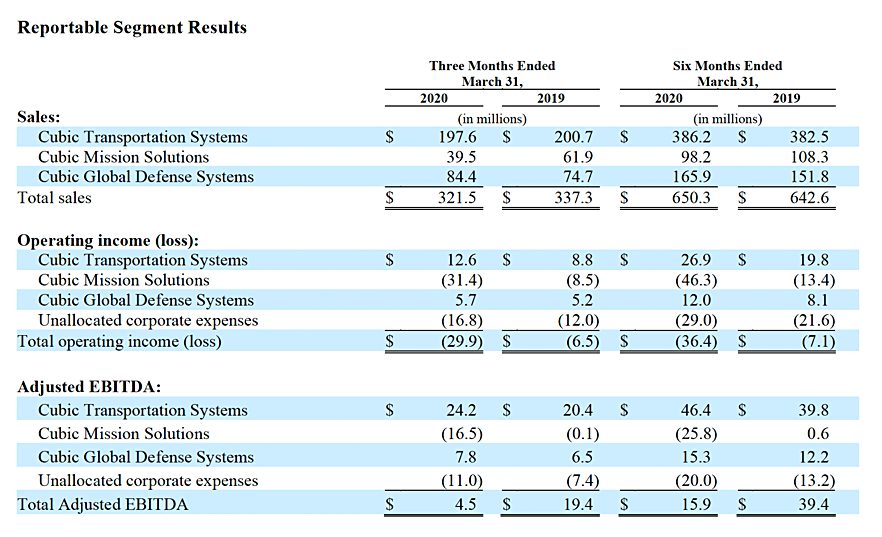

Cubic Transportation Systems

CTS sales decreased 2% to $197.6 million in the second quarter of fiscal 2020, compared to $200.7 million in the second quarter of fiscal 2019. Organic sales were flat, primarily reflecting the timing of project delivery.

CTS Adjusted EBITDA increased 19% to $24.2 million in the second quarter of fiscal 2020, compared to $20.4 million in the second quarter of fiscal 2019, reflecting higher gross margins on service sales as well as benefits from cost management.

Cubic Mission Solutions

CMS sales decreased 36% to $39.5 million in the second quarter of fiscal 2020, compared to $61.9 million in the second quarter of fiscal 2019. Organic sales declined 42% reflecting lower orders and deliveries of expeditionary satellite communications products (GATR) and the timing of orders and deliveries of secure networks products (DTECH). The prior year results were favorably impacted by strong orders for GATR in support of Urgent Operational Needs.

CMS Adjusted EBITDA decreased to negative $16.5 million in the second quarter of fiscal 2020, compared to negative $0.1 million in the second quarter of fiscal 2019. Adjusted EBITDA reflects lower sales of high margin orders, as described above, as well as increased R&D and bid and proposal expenses.

Cubic Global Defense Systems

CGD sales increased 13% to $84.4 million in the second quarter of fiscal 2020, compared to $74.7 million in the second quarter of fiscal 2019. Organic sales growth of 14% was primarily related to increased work on air combat training systems.

CGD Adjusted EBITDA increased 20% to $7.8 million in the second quarter of fiscal 2020, compared to $6.5 million in the second quarter of fiscal 2019, reflecting strong project execution and cost management.

Backlog

Backlog increased by $177.8 million from September 30, 2019 to March 31, 2020. Foreign currency had an unfavorable impact of $37.5 million during the period.

Full Year Fiscal 2020 Guidance

Due to the uncertainty surrounding the COVID-19 pandemic, which is being experienced by both the Company and its customers, Cubic is unable to confidently forecast the impact of COVID-19 and its related effects on its operational and financial results, which could be material. As a result, the Company is suspending its previously announced full year guidance for fiscal 2020.

Conference Call and Webcast Information

Date: May 6, 2020

Time: 5:00 p.m. ET

Hosts: Bradley H. Feldmann, Chairman, President and Chief Executive Officer

Anshooman Aga, Executive Vice President and Chief Financial Officer

Dial in: 844-603-5091

825-312-2261 (international)

Conference ID 5467698

Webcast: https://event.on24.com/wcc/r/2157476/197B36755B67A2C57F7771466F8C38DF

An archive of the webcast will be made available on the Investor Relations section of the company’s website: https://www.cubic.com/investor-relations/earnings.

About Cubic Corporation

Cubic is a technology-driven, market-leading provider of integrated solutions that increase situational understanding for transportation, defense C4ISR and training customers worldwide to decrease urban congestion and improve the militaries’ effectiveness and operational readiness. Our teams innovate to make a positive difference in people’s lives. We simplify their daily journeys. We promote mission success and safety for those who serve their nation. For more information about Cubic, please visit www.cubic.com or on Twitter @CubicCorp.

Media Contact

Laura Chon

Corporate Communications

Cubic Corporation

PH: +1 858-505-2181

Laura.Chon@cubic.com

Investor Contact

Kirsten Nielsen

Investor Relations

Cubic Corporation

PH +1 212-331-9760

Kirsten.Nielsen@cubic.com

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Act”) that are subject to the safe harbor created by the Act. Forward-looking statements include, among others, statements about our expectations regarding future events or our future financial and operating performance and delivering on our strategic growth plan. These statements are often, but not always, made through the use of words or phrases such as “may,” “will,” “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “believe,” “intend,” “predict,” “potential,” “opportunity” and similar words or phrases or the negatives of these words or phrases. These statements involve risks, estimates, assumptions and uncertainties that could cause actual results to differ materially from those expressed in these statements, including, among others: the impact of the COVID-19 outbreak or future epidemics or pandemics on our business, financial condition and operating results; our dependence on U.S. and foreign government contracts; delays in approving U.S. and foreign government budgets and cuts in U.S. and foreign government defense expenditures; the ability of certain government agencies to unilaterally terminate or modify our contracts with them; our assumptions covering behavior by public transit authorities; our ability to successfully integrate new companies, including Trafficware, GRIDSMART, Nuvotronics, Delerrok and Pixia into our business and to properly assess the effects of such integration on our financial condition and operating results; the U.S. government’s increased emphasis on awarding contracts to small businesses, and our ability to retain existing contracts or win new contracts under competitive bidding processes; negative audits by the U.S. government; the effects of politics and economic conditions on negotiations and business dealings in the various countries in which we do business or intend to do business; competition and technology changes in the defense and transportation industries; the change in the way transit agencies pay for transit systems; our ability to accurately estimate the time and resources necessary to satisfy obligations under our contracts; the effect of adverse regulatory changes on our ability to sell products and services; our ability to identify, attract and retain qualified employees; unforeseen problems with the implementation and maintenance of our information systems, including our ERP system; business disruptions due to cyber security threats, physical threats, terrorist acts, acts of nature and public health crises (including COVID-19); our involvement in litigation, including litigation related to patents, proprietary rights and employee misconduct; our reliance on subcontractors and on a limited number of third parties to manufacture and supply our products; our ability to comply with our development contracts and to successfully develop, introduce and sell new products, systems and services in current and future markets; defects in, or a lack of adequate coverage by insurance or indemnity for, our products and systems; and changes in U.S. and foreign tax laws, exchange rates or our economic assumptions regarding our pension plans. In addition, please refer to the risk factors contained in our filings with the Securities and Exchange Commission (the “SEC”) available at www.sec.gov, including our most recent Annual Report on Form 10-K for our fiscal year ended September 30, 2019 and Quarterly Reports on Form 10-Q. Because the risks, estimates, assumptions and uncertainties referred to above could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements, you should not place undue reliance on any forward-looking statements. Any forward-looking statement speaks only as of the date of this press release, and, except as required by law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date of this press release.

Use of Non-GAAP Financial Information

In addition to results reported under U.S. generally accepted accounting principles (“GAAP”), we provide certain financial measures that are not prepared in accordance with GAAP. These non-GAAP measures consist of organic sales growth, Adjusted net income, Adjusted earnings per share (“Adjusted EPS”), Adjusted EBITDA and Adjusted Free Cash Flow. We believe that these non-GAAP measures provide additional insight into our ongoing operations and underlying business trends, facilitate a comparison of our results between current and prior periods, and facilitate the comparison of our operating results with the results of other public companies that provide non-GAAP measures. We use Adjusted EBITDA internally to evaluate the operating performance of our business, for strategic planning purposes, and as a factor in determining incentive compensation for certain employees. These non-GAAP measures facilitate company-to-company operating comparisons by excluding items that we believe are not part of our core operating performance. Organic sales growth is defined as the year-over-year percentage change in reported sales relative to the prior comparable period, excluding the impact of acquisitions and divestitures over the prior 12 months and the impact of foreign currency translation. Adjusted EBITDA is defined as GAAP net income from continuing operations attributable to Cubic before interest expense, loss on extinguishment of debt, income taxes, depreciation and amortization, other non-operating expense, acquisition-related expenses, strategic and information technology (“IT”) system resource planning expenses, restructuring costs, and gains or losses on the disposal of fixed assets. Adjusted net income is defined as GAAP net income from continuing operations attributable to Cubic excluding amortization of purchased intangibles, restructuring costs, loss on extinguishment of debt, acquisition related expenses, strategic and IT system resource planning expenses, gains or losses on the disposal of fixed assets, other non-operating expense (income), tax impacts related to acquisitions, and the impact of the Tax Cuts and Jobs Act (“U.S. Tax Reform”). Adjusted EPS is defined as Adjusted net income on a per share basis using the weighted average diluted shares outstanding. Strategic and IT system resource planning expenses consists of expenses incurred in the development of our ERP system and the redesign of our supply chain which include internal labor costs and external costs of materials and services that do not qualify for capitalization. Acquisition-related expenses include business acquisition expenses including retention bonus expenses, due diligence and consulting costs incurred in connection with the acquisitions, and expenses recognized related to the change in the fair value of contingent consideration for acquisitions.

Adjusted Free Cash Flow is defined as Net cash provided by continuing operations, excluding operating cash flow associated with the Boston Special Purpose Vehicle (the “Boston SPV”) in which Cubic has a 10% equity stake, less capital expenditures plus proceeds from the sale of fixed assets and the receipt of withheld proceeds from the sale of trade receivables. The Boston SPV has contracted with Cubic for the design-build and operations and maintenance phases of the next-generation fare collection system for the Massachusetts Bay Transit Authority and pays Cubic progress payments during the design-build phase of the project. These payments are primarily funded by non-recourse debt issued by the Boston SPV. Additional information regarding the Boston SPV can be found in our Annual Report on Form 10-K for the fiscal year ended September 30, 2019 and our most recent Quarterly Reports on Form 10-Q. Management believes that Adjusted Free Cash Flow is meaningful to investors because management reviews cash flows generated from operations after taking into consideration capital expenditures, which are necessary to maintain and expand Cubic’s business, in addition to the other adjustments noted above. Adjusted Free Cash Flow does not represent the residual cash flow available for discretionary expenditures since other non-discretionary expenditures are not deducted from the measure.

These non-GAAP measures are not measurements of financial performance under GAAP and should not be considered as measures of discretionary cash available to the Company or as alternatives to net income as a measure of performance. In addition, other companies may define these non-GAAP measures differently and, as a result, our non-GAAP measures may not be directly comparable to the non-GAAP measures of other companies. Furthermore, non-GAAP financial measures have limitations as an analytical tool and you should not consider these measures in isolation, or as a substitute for analysis of our results as reported under GAAP. Investors are advised to carefully review our GAAP financial results that are disclosed in our filings with the SEC, including our Annual Report on Form 10-K for the fiscal year ended September 30, 2019 and our most recent Quarterly Reports on Form 10-Q.

We reconcile organic sales growth to sales growth as reported, which we consider to be the most directly comparable GAAP financial measure. We reconcile Adjusted EBITDA and Adjusted net income to GAAP net income, which we consider to be the most directly comparable GAAP financial measure. We reconcile Adjusted EPS to GAAP EPS, which we consider to be the most directly comparable GAAP financial measure. We reconcile Adjusted Free Cash Flow to Net cash provided by continuing operations, which we consider to be the most directly comparable GAAP financial measure. The following tables reconcile these non-GAAP measures to their most directly comparable GAAP financial measure: